Building amortization rate

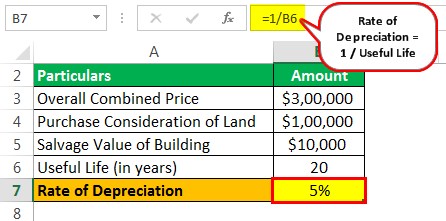

Next determine the depreciation rate category based on the propertys natureIt would be either 5 10 or 100 which would be used to calculate the annual depreciation of the. Before building the table you must have the following information on hand.

/GettyImages-552980487-56a0a5f33df78cafdaa3928e.jpg)

What Is Amortization

Generally speaking amortization is the progressive gradual method through which a loan is slowly eliminated.

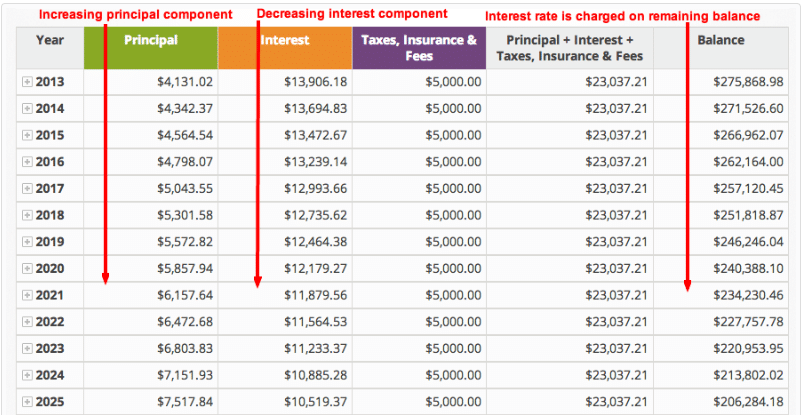

. Building the Variable Rate Loan Amortization Table. Generally amortization schedules only work for fixed-rate loans and not adjustable-rate mortgages variable rate loans or lines of credit. The loan term number of.

The total loan amount. Commissioners Approval Date The statewide average interest rate for prospective projects will be assigned to projects based on CAD and will. It also refers to.

Set up the amortization table. In our example 100000 minus 5000 equals 95000. For tax years beginning in 2022 the maximum section 179 expense deduction is 1080000.

Use it to create an amortization schedule that calculates total interest. In addition one of the. Calculator Rates Commercial Property Loan Calculator.

Multiplying the interest rate by the outstanding balance and. Amortization as a way of. For starters define the input cells where you will.

Stay on top of a mortgage home improvement student or other loans with this Excel amortization schedule. The 15-year rule was enacted by the Internal Revenue Service IRS in 2004. Amortization is the paying off of debt with a fixed repayment schedule in regular installments over a period of time for example with a mortgage or a car loan.

Understanding amortization can help real estate investors reduce project costs and realize tax advantages. Now lets go through the process step-by-step. Building a Debt Amortization Schedule in Excel.

This amount decreases with each payment. Loan Product Rates start as low as LTV. Section 179 deduction dollar limits.

Multiply 150000 by 3512 to get 43750. Start by subtracting the residual value of the building from the cost of the building. This calculator automatically figures the.

Depreciation is the expensing of a fixed asset over its useful life. This is the depreciable value. Industrial Building Loan Interest Rates - Rates updated September 13th 2022.

Interest-Only and Balloon repayments along with providing a monthly amortization schedule. Amortization is the practice of spreading an intangible assets cost over that assets useful life. Thats your interest payment for your first monthly payment.

5 Year Fixed Rates 512 Up to 75. For the premise of this example lets assume we are taking out a 225m loan at a 5 annual interest rate which we will repay. This limit is reduced by the amount by which the cost of.

Since commercial real estate basically means properties which are only. Class 6 10 Include a building in Class 6 with a CCA rate of 10 if it is made of frame log stucco on frame galvanized iron or corrugated metal. The 15-year rule is not permanent and must.

Subtract that from your monthly payment to get your principal payment. Prior to that year the depreciation term was 39 years.

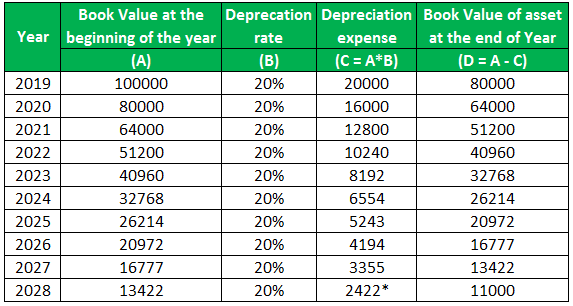

Depreciation Rate Formula Examples How To Calculate

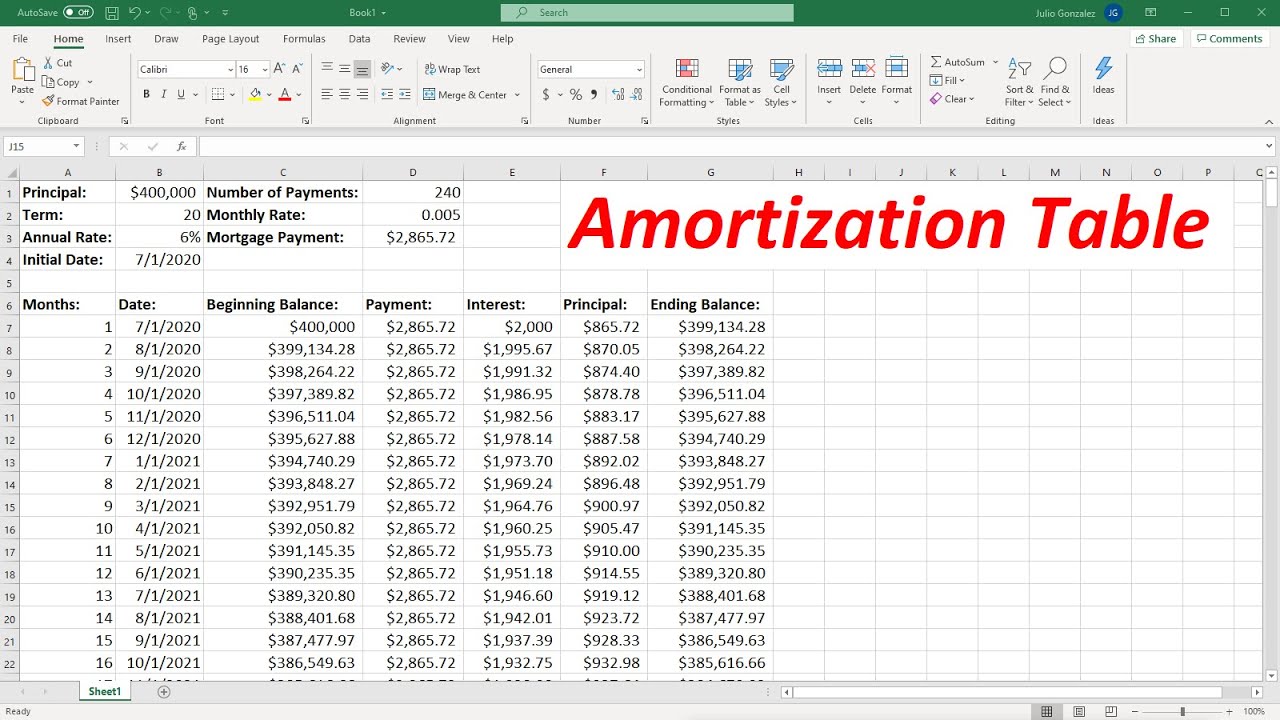

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

Depreciation Of Building Definition Examples How To Calculate

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

Using Percentage Tables To Calculate Depreciation Center For Agricultural Law And Taxation

How To Create An Amortization Table In Excel Youtube

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

:max_bytes(150000):strip_icc()/dotdash_Final_Amortized_Loan_Oct_2020-01-3a606fa9285943098248ac92e8d03b40.jpg)

What Is An Amortization Schedule How To Calculate With Formula

Depreciation Of Building Definition Examples How To Calculate

Depreciation Of Building Definition Examples How To Calculate

Depreciation Schedule Formula And Calculator Excel Template

Using Percentage Tables To Calculate Depreciation Center For Agricultural Law And Taxation

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

Time Value Of Money Board Of Equalization

How To Calculate Amortization Expense For Tax Deductions